By Rosamma Thomas*

The Prime Minister’s National Relief Fund (PMNRF) is meant to collect voluntary donations from the general public, either individuals or organizations, to enable assistance to people in times of natural disaster, or for expensive medical treatment. That fundamental voluntary character of the fund, however, has changed in recent years.

The Prime Minister’s National Relief Fund (PMNRF) is meant to collect voluntary donations from the general public, either individuals or organizations, to enable assistance to people in times of natural disaster, or for expensive medical treatment. That fundamental voluntary character of the fund, however, has changed in recent years.

The gazette notification of January 2018 announcing the Electoral Bond scheme states, in Clause 12 (2): “The amount of bonds not encashed within the validity period of fifteen days shall be deposited by the authorized bank to the Prime Minister’s National Relief Fund”. The Union government has, thus, through notification, directed funds to be deposited into what was meant to be purely voluntary.

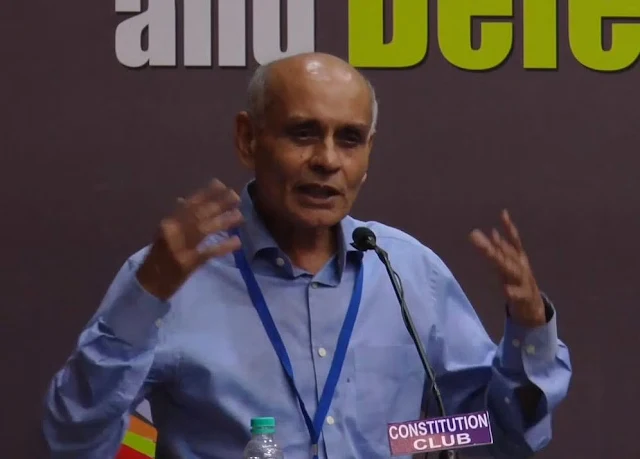

Commodore Lokesh Batra, who has been campaigning for transparency in government functioning, holds that once a gazette notification has been issued directing that funds be deposited into the PMNRF, the character of the whole fund has changed, and it must, without doubt, become a matter covered under the Right to Information Act.

The Central Public Information Officer, Prime Minister’s Office, in response to an appeal filed by Commodore Batra in October 2020, stated: “The Prime Minister’s National Relief Fund is not a public authority under the ambit of Section 2 (h) of the RTI Act, 2005. However, relevant information in respect of PMNRF may be seen on the website – pmnrfgov.in.”

It is pertinent to cite history here: A Press Information Bureau release of January 24, 1948 states: “At no time has the necessity of giving relief to vast numbers of our suffering countrymen been so great and so urgent as it is today,” the release began, detailing the plight of people moving as refugees from the newly formed Pakistan into India.

Commodore Lokesh Batra, who has been campaigning for transparency in government functioning, holds that once a gazette notification has been issued directing that funds be deposited into the PMNRF, the character of the whole fund has changed, and it must, without doubt, become a matter covered under the Right to Information Act.

The Central Public Information Officer, Prime Minister’s Office, in response to an appeal filed by Commodore Batra in October 2020, stated: “The Prime Minister’s National Relief Fund is not a public authority under the ambit of Section 2 (h) of the RTI Act, 2005. However, relevant information in respect of PMNRF may be seen on the website – pmnrfgov.in.”

It is pertinent to cite history here: A Press Information Bureau release of January 24, 1948 states: “At no time has the necessity of giving relief to vast numbers of our suffering countrymen been so great and so urgent as it is today,” the release began, detailing the plight of people moving as refugees from the newly formed Pakistan into India.

Prime Minister Jawaharlal Nehru had been receiving donations from people wishing to help with the effort of rehabilitation, and there was a need to put a system in place to receive these funds and direct them towards relief and rehabilitation of refugees.

“Donations, which will be announced in the press, may be sent to the Central Bank of India, New Delhi, or any of the branches or sub-branches of the bank,” the 1948 release mentioned, inviting donations, and adding that donations could also be earmarked for specific purposes, like medical relief, education or care of orphans.

Contributions flowing from budgetary sources of the government or from balance sheets of public sector undertakings are not accepted in the Fund; conditional contributions are also not accepted, even though donors may indicate their preferences.

The corpus of the fund, drawn entirely from voluntary donations, was invested in scheduled commercial banks and other agencies, and disbursals were made with the approval of the prime minister. A judgment of the Delhi High Court in 2018 stated that in 1973, PMNRF was registered as a “Trust” for purposes of offering exemption from income tax; in 1985, the management of the trust was handed over to the prime minister.

The Delhi HC ruling holds that since disbursals are made under the discretion of the prime minister in his capacity as a constitutional authority, these must be taken to be official decisions. “As is evident from foregoing, it can be reasonably concluded that there exists governmental control in the management of PMNRF. Therefore, the conditions in Clause (i) of Section 2(h)(d) are satisfied.

“Donations, which will be announced in the press, may be sent to the Central Bank of India, New Delhi, or any of the branches or sub-branches of the bank,” the 1948 release mentioned, inviting donations, and adding that donations could also be earmarked for specific purposes, like medical relief, education or care of orphans.

Contributions flowing from budgetary sources of the government or from balance sheets of public sector undertakings are not accepted in the Fund; conditional contributions are also not accepted, even though donors may indicate their preferences.

The corpus of the fund, drawn entirely from voluntary donations, was invested in scheduled commercial banks and other agencies, and disbursals were made with the approval of the prime minister. A judgment of the Delhi High Court in 2018 stated that in 1973, PMNRF was registered as a “Trust” for purposes of offering exemption from income tax; in 1985, the management of the trust was handed over to the prime minister.

The Delhi HC ruling holds that since disbursals are made under the discretion of the prime minister in his capacity as a constitutional authority, these must be taken to be official decisions. “As is evident from foregoing, it can be reasonably concluded that there exists governmental control in the management of PMNRF. Therefore, the conditions in Clause (i) of Section 2(h)(d) are satisfied.

Commodore Lokesh Batra (retired) found that over Rs 20 crore has been deposited into PMNRF through the Electoral Bond scheme

Accordingly, PMNRF is held to be a “public authority” within the scope of RTI Act,” the court ruled.

PMNRF has not been constituted by Parliament, and the Fund, since about 1973, is recognized as a Trust under the Income Tax Act. It is managed by the prime minister, who may delegate his responsibility; the work of the PMNRF is carried out by the prime minister, assisted by officers and staff on an honorary basis. It operates from the Prime Minister’s Office and does not pay any license fee.

PMNRF has not been constituted by Parliament, and the Fund, since about 1973, is recognized as a Trust under the Income Tax Act. It is managed by the prime minister, who may delegate his responsibility; the work of the PMNRF is carried out by the prime minister, assisted by officers and staff on an honorary basis. It operates from the Prime Minister’s Office and does not pay any license fee.

It was formed soon after independence, and the initial 1948 press release mentions that the president of the Congress party would be on its managing committee. PMNRF is exempt under the Income Tax Act, 1961 for return purposes. Contributions are 100% deducted from taxable income.

Through applications under the Right to Information, Commodore Lokesh Batra (retired) found that over Rs 20 crore has thus been deposited into PMNRF through the Electoral Bond scheme.

How then, asks the defence forces veteran, can the PMNRF claim that it is comprised entirely of voluntary donations? “Billionaires buy electoral bonds and make donations to political parties without paying bank charges or commission. Political parties receive these large amounts without paying taxes. It is the common people, taxpayers, who are burdened with the cost of printing the electoral bonds and paying the bank charges for them.”

Given that the deposits from the Electoral Bond scheme are made through a notification and are not voluntary, are there not matters of law that need to be attended to? If the 1948 press release were honoured, however, and all donations were announced in the press, transparency could have been ensured without repeated RTI applications.

Through applications under the Right to Information, Commodore Lokesh Batra (retired) found that over Rs 20 crore has thus been deposited into PMNRF through the Electoral Bond scheme.

How then, asks the defence forces veteran, can the PMNRF claim that it is comprised entirely of voluntary donations? “Billionaires buy electoral bonds and make donations to political parties without paying bank charges or commission. Political parties receive these large amounts without paying taxes. It is the common people, taxpayers, who are burdened with the cost of printing the electoral bonds and paying the bank charges for them.”

Given that the deposits from the Electoral Bond scheme are made through a notification and are not voluntary, are there not matters of law that need to be attended to? If the 1948 press release were honoured, however, and all donations were announced in the press, transparency could have been ensured without repeated RTI applications.

---

*Freelance journalist

*Freelance journalist

Comments